TABLE OF CONTENTS

| | | Page | |||

| | | ||||

| | | ||||

| | |||||

| | | ||||

| | |||||

| | |||||

| | |||||

| HOUSEHOLDING OF PROXY MATERIALS | | | |||

| | |

i

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED SEPTEMBER 12, 2023

STRATA SKIN SCIENCES, INC.

Horsham, Pennsylvania 19044

PROXY STATEMENT FOR THE

Why am I receiving these materials?

We sent you this Proxy Statement and the enclosed proxy card because the Board of Directors of STRATA Skin Sciences, Inc. ("we"(“we”, "us"“us”, "our"“our”, or "the Company"“the Company”) is soliciting your proxy to vote at our 20172023 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”). You are invited to attend the Annual Meeting, and we request that you vote on the proposals described in this Proxy Statement. You do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or you may grant a proxy to vote your shares by means of the telephone or on the Internet.

We intend to mail this Proxy Statement and the accompanying proxy card together with our 20162023 Annual Report to Stockholders on or about August 2, 2017, 2023 to all stockholders of record on July 18, 2017September 12, 2023 (the “record date”) entitled to vote at the Annual Meeting. Each share of common stock outstanding on the record date will be entitled to one vote.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on July 18, 2017the record date will be entitled to vote at the Annual Meeting. On this record date, there were 2,477,74334,913,935 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on July 18, 2017the record date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Throughout this Proxy Statement, we refer to these holders as “stockholders of record.”

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, on July 18, 2017the record date, your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in "street name"“street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. Since you are not the stockholder of record, however, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid legal proxy from your broker or other agent. Throughout this Proxy Statement, we refer to these holders as “street name stockholders.”

What am I voting on?is the purpose of the Annual Meeting?

| 1. |

| 2. | |||

| 3. | approve an amendment to our existing Certificate of Incorporation (our “Current Charter”) to effect a reverse stock split of our common stock at a reverse stock split ratio not less than 1-for-5 and no greater |

1

than 1-for-25, with the exact split ratio, if approved and effected at all, to be set within that range at the discretion of the Board and publicly announced by the Company within 6 months after stockholder approval at the Annual Meeting without further approval or authorization of the Company’s stockholders (the “Reverse Stock Split Proposal”);

| 4. | an advisory vote to approve the compensation of the Company’s named executive officers; |

| 5. | an advisory vote on the frequency of future advisory votes to approve the compensation of the Company’s named executive officers; and |

| 6. |

How do I vote?

You may either vote "For"“For” all the nominees to the Board of Directors or you may "Withhold"“Withhold” your vote for any nominee you specify. For each of the other matters you may vote "For"“For” or "Against"“Against” or abstain from voting. Procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, or vote by proxy using the enclosed proxy card or via the Internet or telephone (see "Voting“Voting Via the Internet or by Telephone"Telephone” below). If you vote by proxy, your shares will be voted as you specify on the proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person if you have already voted by proxy.

To vote using the enclosed proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your broker, bank or other agent included with thesesigned proxy materials, or contactcard to us before the Annual Meeting, we will vote your broker, bank or other agent to request a proxy form.shares as you direct.

Voting Via the Internet or by Telephone

Stockholders may grant a proxy to vote their shares by means of the telephone or via the Internet. The laws of the State of Delaware, under which we are incorporated, specifically permit electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the Inspector of Elections can determine that such proxy was authorized by the stockholder.

The telephone and Internet voting procedures below are designed to authenticate stockholders' identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders' instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which must be borne by the stockholder.

Stockholders of record may go to www.proxyvote.com to grant a proxy to vote their shares by means of the Internet. They will be required to provide the control number contained on their proxy cards. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-690-6903and following the operator's instructions.

General Information for All Shares Voted Via the Internet or by Telephone

Votes submitted via the Internet or by telephone must be received by 11:59 p.m. EST on September 13, 2017., 2023. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a street name stockholder, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card or voting instructions as instructed by your broker, bank or other agent to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid legal proxy from your broker, bank, or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

2

Most street name stockholders receive instructions for granting proxies from their banks, brokers or other agents, rather than the proxy card.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of our common stock you own as of July 18, 2017.the record date.

What if I return a proxy card but do not make specific choices?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board of Directors on the matters presented in this Proxy Statement and as the proxy holders may determine in their discretion for any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial ownerstreet name stockholder, you will have received these proxy materials from that organization holding your account, and you have the right to instruct your broker, bank, trustee, or nominee how to vote the shares held in your account. If no voting instructions are given, your broker or nominee has discretionary authority to vote your shares on your behalf on routine matters as determined in accordance with NYSE Rule 452 by The New York Stock Exchange, which applies to brokers, banks and other securities intermediates in respect to proxy voting, including with respect to Nasdaq-listed companies, proposals are considered “routine” or “non-routine”. In the absence of shares registered in the name oftimely directions, your broker, bank or other agent and do not provide the organization that holds your shares with specific voting instructions, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on hownominee will have discretion to vote your shares on a non-routine matter,“routine” matters: the organization that holds your sharesratification of the appointment by the Audit Committee of the Board of Directors of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 and the Reverse Stock Split Proposal. Your broker, bank or other nominee will inform the inspector of election that it does not have the authoritydiscretion to vote on thisany other proposals, which are considered “non-routine” matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our sole routine matter, but is not able to vote your shares on the non-routine matters, then those shares will be treated as “broker non-votes” with respect to your shares. This is referred tothe non-routine proposals. Accordingly, if you own shares through a nominee, such as a "broker non-vote."broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals. You may not vote shares held in street name at the Annual Meeting unless you obtain a legal proxy from that organization holding your account.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed and posted proxy materials, we will bear the cost of proxies solicited by the Board of Directors. In addition to the solicitation of proxies by mail, solicitation may be made personally or by telephone or electronic communication by our directors, officers and employees, none of whom will receive additional compensation for these services. We will also reimburse brokers and other nominees for their reasonable out-of-pocket expenses incurred in connection with distributing forms of proxies and proxy materials to the beneficial owners of common stock.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy at any time before the final vote at the meeting. If you are thea stockholder of record, holder of your shares, you may revoke your proxy in any one of four ways:

you may send a written notice, dated later than the proxy, that you are revoking your proxy to our Secretary at 5 Walnut Grove Drive, Suite 140, Horsham, Pennsylvania 19044 that is received by us prior to the Annual Meeting;

you may submit a new vote by telephone or via the Internet; or

If your sharesyou are held by your broker or bank as a nominee or agent,street name stockholder, you must follow the instructions provided by your broker or bank.

Why is the Company seeking approval for a reverse stock split?

Our common stock is currently listed on Nasdaq under the symbol “SSKN.” The continued listing requirements of Nasdaq provide, among other things, that our common stock must maintain a closing bid price of at least $1.00 per share. On June 29, 2023, we received a notification from the Listing Qualifications Department of Nasdaq indicating that for the last 30 consecutive business days, the closing bid price of our common stock was below $1.00 per share, which is the minimum required closing bid price for continued listing on the Nasdaq Capital Marke3 pursuant to Listing Rule 5450(a)(1). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has 180 calendar days, or until December 26, 2023 to regain compliance. To regain compliance, the closing bid price of our common stock must be at least $1.00 per share for a minimum of ten consecutive business days. If the Company does not regain compliance by December 26, 2023, the Company may be eligible for a second 180-calendar-day period, provided that the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing requirements for Nasdaq, other than the minimum bid price requirement, and the Company provides written notice to Nasdaq of its intention to cure the deficiency during the second compliance period.

If the Company is not eligible for the second compliance period or Nasdaq concludes that the Company will not be able to cure the deficiency during the second compliance period, Nasdaq will provide written notice to the Company that the Company’s common stock will be subject to delisting. In the event of such notification, the Company may appeal Nasdaq’s determination to delist its securities, but there can be no assurance that Nasdaq would grant the Company’s request for continued listing.

As of September 11, 2023, the closing bid price per share of our common stock was $0.59. There can be no assurance that the trading price of our common stock will not remain below $1.00 per share in the future, including as a result of the Private Placement. In order to ensure continued compliance with Nasdaq listing rules, and listing on Nasdaq, we are requesting stockholder approval of a reverse stock split of our common stock, as further described in the Reverse Stock Split Proposal of this Proxy Statement.

Our Board has approved the reverse stock split as a means of increasing the share price of our common stock. Our Board believes that it is in our best interests to maintain our Nasdaq listing to provide for broader trading of our common stock and to facilitate the use of our common stock in financing and other transactions. We expect the reverse stock split to facilitate the continuation of our Nasdaq listing. We cannot assure you, however, that the reverse stock split will result in an increase in the per share price of our common stock, or if it does, how long the increase would be sustained, if at all. To the extent the share price does not rise proportionately to the reverse stock split, the end result could be a loss of value.

What are the consequences of being delisted from The Nasdaq Stock Market?

If we do not effect the reverse stock split, it is likely that we will not be able to meet the $1 minimum closing bid price continued listing requirements of Nasdaq, and, consequently, our common stock would be delisted from Nasdaq. If we are delisted from Nasdaq, we may be forced to seek to be traded on the OTC Bulletin Board or the “pink sheets,” which would require our market makers to request that our common stock be so listed. There are a number of negative consequences that could result from our delisting from Nasdaq, including, but not limited to, the following:

The liquidity and market price of our common stock may be negatively impacted and the spread between the “bid” and “asked” prices quoted by market makers may be increased;

Our access to capital may be reduced, causing us to have less flexibility in responding to our capital requirements;

Existing or prospective institutional investors may be less interested or prohibited from investing in our common stock, which may cause the market price of our common stock to decline;

4

Our common stock will no longer be deemed a “covered security” under Section 18 of the Securities Act of 1933, as amended, and, as a result, we will lose our exemption from state securities regulations. This means that granting stock options and other equity incentives to our employees will be more difficult; and

If our stock is traded as a “penny stock,” transactions in our stock would be more difficult and cumbersome.

How will the reverse stock split work?

Instead of being asked to approve a fixed number of shares of common stock that will be combined into one share of common stock, the Company’s stockholders are being asked to approve a range of shares of common stock – between 1-for-5 and 1-for-25 shares – which will be combined into one share of common stock. Approval of this range will authorize our Board in its discretion to effect the reverse stock split using any exchange ratio within the range, or not to effect a reverse stock split at all.

Why am I being asked to approve a range of reverse split ratios rather than a fixed ratio?

Our Board believes it is in the best interest of the Company and its stockholders that our Board retain the discretion to fix the exact reverse split exchange ratio immediately prior to consummation of the reverse split. Our stock price has experienced significant volatility recently due to a combination of factors, including the announcement of the Private Placement, our Nasdaq continued listing deficiency, the market’s perceptions of our operational and financial results and prospects, as well as recent downturns in our industry and general economic conditions as a whole. Further, we have a number of potential milestones and other events that may occur or otherwise be announced that could positively or negatively affect our stock price and thus impact the reverse split exchange ratio. Should our stockholders approve our Reverse Stock Split Proposal, our Board will take into account our then-current stock price and appropriate related factors before determining a final reverse split ratio.

If the stockholders approve the Reverse Stock Split Proposal, when would the Company implement the reverse stock split?

We currently expect that the reverse stock split will be implemented as soon as practicable after the receipt of the requisite stockholder approval so as to provide sufficient time for the closing bid price of our stock to exceed $1 for at least ten (10) consecutive trading days prior to December 26, 2023. However, our Board will have the discretion to delay or abandon the reverse stock split if believes it to be in the best interests of the Company and our stockholders to do so. If the Company does not regain compliance by December 26, 2023, the Company may be eligible for a second 180-calendar-day period, provided that the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing requirements for Nasdaq, other than the minimum bid price requirement, and the Company provides written notice to Nasdaq of its intention to cure the deficiency during the second compliance period.

If the Reverse Stock Split Proposal is approved and effected at all, the reverse split ratio will be set at the discretion of the Board and publicly announced by us within 6 months after stockholder approval at the Special Meeting without further approval or authorization of our stockholders.

What would be the principal effects of the reverse stock split?

The reverse stock split will have the following effects:

the market price of our common stock immediately upon effect of the reverse stock split is expected to increase over the market price of our common stock immediately prior to the reverse stock split;

the number of shares of our common stock outstanding and reserved for issuance (including shares issuable upon exercise of outstanding warrants and equity incentive awards) will be reduced to between one-fifth (1/5) and one-twenty-fifth (1/25) of the number of shares currently outstanding (except for the effect of eliminating fractional shares), depending upon the reverse split exchange ratio determined by our Board;

the number of authorized shares of our common stock will be maintained at 150,000,000 shares and the number of authorized shares of our preferred stock will be maintained at 10,000,000 (which amounts are not otherwise affected by the reverse stock split); and

the reverse stock split will have no effect on the proportion of our shares owned by each stockholder relative to the number of our total shares outstanding.

5

If I hold pre-split stock certificates, are these certificates still good after the reverse stock split? Do I need to exchange them for new stock certificates?

As of the effective date of the reverse stock split, each certificate representing pre-split shares of common stock will, until surrendered and exchanged, be deemed to represent only the relevant number of post-split shares of common stock as a result and at the time of the reverse stock split. As soon as practicable after the effective date of the reverse stock split, our transfer agent, American Stock Transfer & Trust Company, LLC, will mail you a letter of transmittal. Upon receipt of your properly completed and executed letter of transmittal and your stock certificate(s), you will be issued the appropriate number of shares of the Company’s common stock either as stock certificates (including legends, if appropriate) or electronically in book-entry form, as determined by the Company.

What if I hold some or all of my shares electronically in book-entry form and I am a registered stockholder? Do I need to take any action to receive post-split shares?

If you hold shares of our common stock in book-entry form (that is, you do not have stock certificates evidencing your ownership of our common stock but instead received a statement reflecting the number of shares registered in your account), you do not need to take any action to receive your post-split shares. If you are entitled to post-split shares, a transaction statement will be sent automatically to your address of record indicating the number of shares you hold. However, if you hold any shares in certificated form, you must still surrender and exchange your stock certificates for those shares and provide a properly completed and executed letter of transmittal.

What if I hold some or all of my shares in street name (that is, through a broker, bank or other third party institution)? Do I need to take any action to receive post-split shares?

If you hold shares of our common stock in street name through a brokerage, bank or other third-party institution (that is, you do not have stock certificates evidencing your ownership of our common stock but instead received a statement reflecting the number of shares registered in your account from your broker, bank or other third party nominee), you do not need to take any action to receive your post-split shares. If you are entitled to post-split shares, your next transaction statement from your broker, bank or other third-party nominee will indicate the number of shares you hold on a post-reverse split basis.

What happens to any fractional shares resulting from the reverse stock split?

Stockholders will not receive fractional post-reverse stock split shares in connection with the reverse stock split. Instead, stockholders of record who otherwise would be entitled to receive fractional shares will be entitled to an amount of cash equal to the product of (i) the fractional share to which the holder would otherwise be entitled and (ii) the closing price per share on the trading day immediately preceding the effective time of the reverse stock split.

What happens to equity awards under the Company’s equity incentive plans as a result of the reverse stock split?

All shares of the Company’s common stock subject to outstanding equity awards under 2016 Amended and Restated Omnibus Incentive Plan (the “Plan”) and grant of options to Robert Moccia granted in March 2021, which was not granted under the Plan, will be converted and combined upon the effective date of the reverse stock split into common stock at the ratio determined by our Board (and subject to adjustment for fractional interests). In addition, the exercise price of applicable outstanding equity awards (including stock options and stock appreciation rights) will be proportionately increased such that the approximate aggregate exercise prices for such equity awards will remain the same following the reverse stock split. No fractional shares will be issued pursuant to the Plan or the options to Robert Moccia granted in March 2021 following the reverse stock split. Therefore, if the number of shares subject to the outstanding equity awards immediately before the reverse stock split is not evenly divisible (in other words, it would result in a fractional interest following the reverse stock split), the number of shares of common stock issuable pursuant to such equity awards (including upon exercise of stock options and settlement of restricted stock units) and the exercise or purchase price related thereto, as applicable, would be equitably adjusted in accordance with the terms of the Plan and the options to Robert Moccia granted in March 2021, as applicable, which may include rounding the number of shares of common stock issuable to the nearest whole share.

6

When are stockholder proposals due for next year's annual meeting?

Under Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), our stockholders may present proper proposals for inclusion in our Proxy Statement and for consideration at the next annual meeting of stockholders by submitting their proposals to us in a timely manner. In order to be considered for inclusion in the Proxy Statement distributed to stockholders prior to the annual meeting of stockholders in the year 2018,2024, a stockholder proposal must be received by us no later than April 4, 2018, 2024 and must otherwise comply with the requirements of Rule 14a-8.

In order to be considered for presentation at the annual meeting of stockholders in the year 2018,2024, although not included in the Proxy Statement, a stockholder proposal or nomination(s) must comply with the requirements of our FourthFifth Amended and Restated Bylaws (the "Bylaws"“Bylaws”) and be received by us nonot later than the close of business on June 16, 2018 and nothe 90th day nor earlier than the close of business on May 17, 2018;the 120th day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the 2018 annual meeting2023 Annual Meeting is more than thirty (30) days before or more than sixty (60) days after September 14, 2018,, 2023, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the one hundred and twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the close of business on the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by us. For the 2024 Annual Meeting of Stockholders, this period will begin on , 2024, and end on , 2024. In the event that the number of directors to be elected to the Board of Directors of the Corporation is increased and there is no public announcement (as defined in the Bylaws) by the Company naming all of the nominees for director or specifying the size of the increased Board of Directors at least 75 days prior to the first anniversary of the preceding year's annual meeting (or, if the annual meeting is held more than 30 days before or 60 days after such anniversary date, at least 75 days prior to such annual meeting), a stockholder's notice required by the Bylaws shall also be considered timely, but only with respect to nominees for any new positions created by such increase, if it shall be delivered not later than the close of business on the tenth (10th) day following the day on which such public announcement is first made by the Company. Stockholder proposals should be delivered in writing to STRATA Skin Sciences, Inc., 100 Lakeside5 Walnut Grove Drive, Suite 100,140, Horsham, Pennsylvania 19044, Attention: Corporate Secretary. A copy of our Bylaws may be obtained from us upon written request to the Secretary.

How are votes counted?

Votes will be counted by the Inspector of Elections appointed for the meeting, who will separately tabulate "For"“For”, "Against"“Against” and "Withhold"“Withhold” votes, abstentions and broker non-votes. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions). If your shares are held by your broker as your nominee (that is, in "street name"), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to "discretionary" items, but not with respect to "non-discretionary" items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

Proposal No. 2, the ratification of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy to be approved. Abstentions will have the same effect as an “Against” vote. Broker non-votes will have no effect on the outcome of the vote.

Proposal No. 3, approval of the Reverse Stock Split Proposal, requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. You may vote “For” or “Against” this proposal, or you may indicate that you wish to “Abstain” from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will have the same effect as a vote “Against” this proposal. Each broker non-vote will be counted for purposes of determining the presence or absence of a quorum but will have no effect on this proposal. This proposal is considered a routine proposal, and therefore we do not expect any broker non-votes with respect to such proposal.

Proposal No. 4, approval of the advisory vote to approve the compensation of the Company’s named executive officers, requires the affirmative vote of a majority of the voting power of the shares present in

person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. You may vote “For” or “Against” this proposal, or you may indicate that you wish to “Abstain” from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will have the same effect as a vote “Against” this proposal. Each broker non-vote will be counted for purposes of determining the presence or absence of a quorum but will have no effect on this proposal. This proposal is not binding on the Company.

Proposal No. 5, an advisory vote on the frequency of future advisory votes to approve the compensation of the Company’s named executive officers, requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. You may vote “For” or “Against” any of the options under this proposal, or you may indicate that you wish to “Abstain” from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will have the same effect as a vote “Against” this proposal. Each broker non-vote will be counted for purposes of determining the presence or absence of a quorum but will have no effect on this proposal. This proposal is not binding on the Company.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least one-third of the outstanding shares of common stock entitled to vote are represented by votes at the Annual Meeting or by proxy. On the record date, there were 2,477,74334,913,935 shares of common stock outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting or by telephone or via the Internet. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting or a majority of the votes present at the Annual Meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K filed by us within four business days offollowing the Annual Meeting.

How can I obtain additional copies?

For additional copies of this Proxy Statement and the enclosed proxy card and 20162023 Annual Report to Stockholders, you should contact our corporate office at STRATA Skin Sciences, Inc., 100 Lakeside5 Walnut Grove Drive, Suite 100,140, Horsham, Pennsylvania 19044, Attention: Corporate Secretary, telephone (215) 619-3200.

The following table sets forth certain information regardingreflects, as of March 31, 2023, the beneficial common stock ownership of: (a) each of our directors, (b) each executive officer, (c) each person known by us to be a beneficial holder of five percent (5%) or more of our common stock, par value $0.001, as of July 10, 2017 by: (i) each director and nominee for director; (ii) each of our executive officers who are named in the Summary Compensation Table presented herein; (iii)(d) all of our executive officers and directors as a group; and (iv) all those known by us to be beneficial owners of more than five percent of its common stock.

Name and Address Of Beneficial Owner (1) | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned (1) |

Francis J. McCaney (2) | 4,000 | * |

Christina L. Allgeier (3) | 6,250 | * |

Jeffrey F. O'Donnell, Sr. (4) | 130,856 | 5.02% |

Samuel E. Navarro (5) | 130,276 | 5.00% |

David K. Stone (6) | 32,007 | 1.28% |

Kathryn Swintek (7) | 31,566 | 1.27% |

LuAnn Via (8) | 31,827 | 1.26% |

James Coyne (9) | - | * |

All directors and officers as a group (eight persons) (10) | 366,782 | 12.92% |

Broadfin Healthcare Master Fund, Ltd (11) | 1,008,297 | 9.99% |

Sabby Healthcare Master Fund, Ltd (12) | 998,019 | 9.99% |

Sabby Volatility Warrant Master Fund, Ltd (13) | 116,571 | 9.99% |

Name and Address of Beneficial Owner(1) | | | Number of Shares Beneficially Owned | | | Percentage of Shares Beneficially Owned(1) |

Uri Geiger(8) | | | 12,112,627 | | | 34.73% |

Robert J. Moccia(2) | | | 1,221,694 | | | 3.5% |

Nachum Shamir | | | 229,414 | | | * |

Douglas Strang(3) | | | 53,977 | | | * |

Patricia Walker(4) | | | 53.215 | | | * |

William Humphries(5) | | | 176,097 | | | * |

Shmuel Rubinstein | | | 125,703 | | | * |

Christopher Lesovitz(6) | | | 110,631 | | | * |

Shmuel Gov(7) | | | 314,999 | | | |

All directors and officers as a group (eight persons) | | | 13,399,106 | | | 40.43% |

| | | | | |||

Accelmed Partners LP(8) | | | 12,112,627 | | | 35.84% |

Nantahala Capital Management, LLC(9) | | | 4,393,685 | | | 12.6% |

22NW Fund, LP(10) | | | 3,439,261 | | | 9.86% |

| * | Less than 1%. |

| (1) | Beneficial ownership is determined in accordance with the rules of the |

| (2) | Includes |

| (3) | Includes |

| (4) | Includes 66,136 shares, |

| (5) | Includes 20,000 options granted on being appointed to the Board. Also includes only the vested portion of a grant of 411,124 options granted on August 23, 2021. |

| (6) | Christopher Lesovitz became the Company’s CFO on October 15, 2021 and has been awarded 450,000 options all of which vest over a four year period from the date of grant. |

| (7) | Shmuel Gov became the Company’s Senior Vice President-General Manager, Carlsbad Operations, on April 1. 2022. Holdings consist of exercisable options to purchase |

| (8) |

| The business address of |

| (9) | The business address of Nantahala Capital Management, LLC (“Nantahala”) is 130 Main Street, 2nd Floor, New Canaan, CT 06840. Nantahala may be deemed to |

| The business address of |

Independence of the Board of Directors

As required under the listing standards of the NASDAQ Stock Market ("NASDAQ"(“NASDAQ”), a majority of the members of a listed company's Board of Directors must qualify as "independent,"“independent,” as affirmatively determined by the Board of Directors. Our Board of Directors consults with our counsel to ensure that the Board of Director's determinations are consistent with all relevant securities and other laws and regulations regarding the definition of "independent,"“independent,” including those set forth in pertinent listing standards of NASDAQ, as are in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and us, its senior management and its independent registered public accounting firm, the Board of Directors has affirmatively determined that the majority of our directors and director nominees are independent directors within the meaning of the applicable NASDAQ listing standards. Except Francis J. McCaney, our President and Chief Executive Officer as well as Mr. O'Donnell and Mr. Navarro, who receive consulting fees, all otherAll current members of the Board of Directors, other than Robert Moccia, are independent under the applicable listing standards of NASDAQ.

Board Leadership Structure

Our Board of Directors administers its risk oversight function as a whole by making risk oversight a matter of collective consideration. While management is responsible for identifying risks, our Board of Directors has charged the Audit Committee of the Board of Directors with evaluating financial and accounting risk, the CompensationCompensation/Nominating and Governance Committee of the Board of Directors with evaluating risks associated with employees and compensation. Investor-related risks are usually addressed by the Board as a whole.

The Board of Directors met sixin person or by unanimous consent 10 times during the last fiscal year. During the last fiscal year, the audit committeeAudit Committee met four times, the compensation committee met sevenin person or by unanimous consent 7 times, and the nominatingCompensation/Nominating and corporate governance committeeGovernance Committee met twoin person or by unanimous consent 8 times. All directors attended at least 75% of the aggregate meetings of the Board of Directors and the committees on which they served that were held during the period in which they were a director and a committee member.

Information Regarding the Board of Directors and its Committees

Our Board of Directors has an audit committee, a compensation committeeAudit Committee and a nominatingCompensation/Nominating and governance committee.Governance Committee. The following table provides membership information for each of these committees:

Name | | | | Nominating and Corporate Governance | ||

Dr. Uri Gieger, Chairman | | | | | ||

William Humphries | | | | | X | |

Nachum Shamir | | | X* | |||

Douglas Strang | X* | | | |||

Samuel Rubinstein | X | | | X | ||

Patricia Walker | | X | | |

| * | Committee Chair |

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage independent advisors, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding "independence"“independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to us.

Audit Committee

The current members of our audit committeeAudit Committee are Kathryn Swintek, David K. Stone,Douglas Strang (Chair), Samuel Rubinstein, and LuAnn Via,Patricia Walker, each of whom we believe satisfies the independence requirements of NASDAQ and the SEC. Ms. SwintekMr. Strang chairs this committee.committee and has been designated as the “Audit Committee financial expert” under Item 407(d)(5) of

10

Regulation S-K. The Board of Directors determined in 2016 that each of Ms. Swintek and Mr. Stonemember of the audit committee satisfies the independence and other composition requirements of the SEC and NASDAQ. Upon Ms. Via's joining the audit committee in February 2017, the Board of Directors determined that she alsoAudit Committee satisfies the independence and other composition requirements of the SEC and NASDAQ. Our Board of Directors has determined that each member of the audit committee qualifies as an "audit committee financial expert" under Item 407(d)(5) of Regulation S-K andAudit Committee has the requisite accounting or related financial expertise required by applicable NASDAQ rules. Our audit committeeAudit Committee assists our Board of Directors in its oversight of:

| appointing, evaluating and determining the compensation of our independent auditors; reviewing and approving the scope of the annual audit, the audit fee and the financial statements; reviewing disclosure controls and procedures, internal control over financial reporting, any internal audit function and corporate policies with respect to financial information; reviewing other risks that may have a significant impact on our financial statements; preparing the Audit Committee report for inclusion in the annual proxy statement; establishing procedures for the receipt, retention and treatment of complaints regarding accounting and auditing matters; approving all related person transactions, as defined by applicable SEC Rules, to which we are a party; and evaluating annually the Audit Committee charter. The Audit Committee | ||

The charter of our audit committeeAudit Committee is available in the Corporate Governance section of the Investor Relations section of our website at www.strataskinsciences.com.www.strataskinsciences.com.

Compensation and Nominating/Governance Committee

The current members of our compensation committeeCompensation and Nominating/Governance Committee are LuAnn Via, James Coyne, Kathryn SwintekNachum Shamir (Chair), Samuel Rubinstein, and David K. Stone,William Humphries each of whom we believe satisfies the independence requirements of NASDAQ. Ms. ViaMr. Shamir chairs this committee. The purpose of our compensation committeeCompensation/Nominating and Governance Committee is to assist in the responsibilities of the Board of Directors relating to compensation of our executive officers. In addition to its role in compensation matters, the purpose of our Compensation and Nominating/Governance Committee is to review all Board of Director-recommended and stockholder-recommended nominees, determine each nominee's qualifications and to make a recommendation to the full Board of Directors as to which persons should be the Board of Directors' nominees. Specific responsibilities of our compensationthe committee include:

| reviewing and approving objectives relevant to executive officer compensation; | ||

evaluating performance and recommending to the Board of Directors the compensation, including any incentive compensation, of the Chief Executive Officer and other executive officers in accordance with such objectives;

reviewing employment agreements for executive officers;

recommending to the Board of Directors the compensation for our directors;

administering our equity compensation plans and other employee benefit plans;

evaluating human resources and compensation strategies, as needed;

identifying and recommending to the Board of Directors individuals qualified to become members of the Board of Directors;

recommending to the Board of Directors the director nominees for the next annual meeting of stockholders;

recommending to the Board of Directors director committee assignments;

reviewing and evaluating succession planning for the Chief Executive Officer and other executive officers;

monitoring the independence of the directors;

developing and overseeing the corporate governance principles applicable to members of the Board of Directors, officers and employees;

reviewing and approving director compensation and administering the Non-Employee Director Plan;

evaluating annually the Compensation and Nominating/Governance Committee charter.

The CompensationCompensation/Nominating and Governance Committee reviews executive compensation from time to time and reports to the Board of Directors, which makes all final decisions with respect to executive compensation. The CompensationCompensation/Nominating and Governance Committee adheres to several guidelines in carrying out its responsibilities, including performance by the employees, our performance, enhancement of stockholder value, growth of new businesses and new markets and competitive levels of fixed and variable compensation.

The Compensation/Nominating and Governance Committee considers potential candidates recommended by its members, management and others, including stockholders. In considering candidates recommended by stockholders, the committee will apply the same criteria it applies in connection with candidates recommended by the Compensation/Nominating and Governance Committee. Stockholders may propose candidates to the Compensation/Nominating and Governance Committee by delivering a notice to the Compensation/Nominating and Governance Committee that contains the information required by the Bylaws. The Compensation/Nominating and Governance Committee did not pay any fee to any third party to search for, identify and/or evaluate the 2023 nominees for directors.

The Compensation/Nominating and Governance Committee does not maintain a formal diversity policy with respect to the identification or selection of directors for nomination to the Board of Directors. Diversity is just one of many factors the Compensation/Nominating and Governance Committee considers in the identification and selection of director nominees. The Company defines diversity broadly to include differences in race, gender, ethnicity, age, viewpoint, professional experience, educational background, skills and other personal attributes that can foster board heterogeneity in order to encourage and maintain board effectiveness.

The charter of our compensation committeeCompensation/Nominating and Governance Committee is available in the Corporate Governance section of the Investor Relations section of our website at www.strataskinsciences.com.www.strataskinsciences.com.

The Board of Directors' Role in Risk Oversight

Our Board of Directors administers its risk oversight function as a whole by making risk oversight a matter of collective consideration. While management is responsible for identifying risks, the Board of Directors has charged the audit committeeAudit Committee of the Board of Directors with evaluating financial and accounting risk and the compensation committeeCompensation/Nominating and Governance Committee of the Board of Directors with evaluating risks associated with employees and compensation. Investor-related risks are usually addressed by the Board of Directors as a whole.

Stockholder Communications with the Board of Directors

The Board of Directors has established a process for stockholders to communicate with the Board of Directors or with individual directors. Stockholders who wish to communicate with the Board of Directors or with individual directors should direct written correspondence to Jay Sturm, CorporateGeneral Counsel atjsturm@strataskin.com or to the following address (our principal executive offices): Board of Directors, c/o Corporate Secretary, 100 Lakeside5 Walnut Grove Drive, Suite 140, Horsham, Pennsylvania 19044. Any such communication must contain:

| a representation that the stockholder is a holder of record of our capital stock; the name and address, as they appear on our books, of the stockholder sending such communication; and the class and number of shares of our capital stock that are beneficially owned by such stockholder. |

Mr. Sturm, as the Corporate Secretary, will forward such communications to the Board of Directors or the specified individual director to whom the communication is directed unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or to take appropriate legal action regarding such communication.

12

Code of Conduct

We have adopted the Code of Business Conduct and Ethics,

The audit committeeAudit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal control over financial reporting and disclosure controls and procedures. In fulfilling its oversight responsibilities, the audit committeeAudit Committee reviewed the audited financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 20162022 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committeeAudit Committee is responsible for reviewing, approving and managing the engagement of the Company's independent registered public accounting firm, including the scope, extent and procedures of the annual audit and compensation to be paid therefore, and all other matters the audit committeeAudit Committee deems appropriate, including the Company's independent registered public accounting firm's accountability to the Board of Directors and the audit committee.Audit Committee. The audit committeeAudit Committee reviewed with the Company's independent registered public accounting firm,firms, which isare responsible for expressing an opinion on the conformity of audited financial statements with generally accepted accounting principles, itstheir respective judgment as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the audit committeeAudit Committee by the Standards of the Public Company Accounting Oversight Board ("PCAOB"(“PCAOB”), includingincluding; PCAOB Auditing Standard No. 16,Communications With Audit Committees,, the rules of the Securities and Exchange Commission ("SEC"(“SEC”) and other applicable regulations,regulations; and discussed and reviewed the results of the Company's independent registered public accounting firm's examination of the financial statements. In addition, the audit committeeAudit Committee discussed with the Company's independent registered public accounting firmfirms the independent registered public accounting firm'sfirms’ independence from management and the Company, including the matters in the written disclosures, and the letter regarding its independence by Rule 3526 of the PCAOB regarding the independent registered public accounting firm'sfirms’ communications with the audit committeeAudit Committee concerning independence. The audit committeeAudit Committee also considered whether the provision of non-audit services was compatible with maintaining the independent registered public accounting firm'sfirms’ independence.

The audit committeeAudit Committee discussed with the Company's independent registered public accounting firmfirms the overall scope and plans for its audits and received from them written disclosures and letter regarding their independence. The audit committeeAudit Committee meets with the Company's independent registered public accounting firm,firms, with and without management present, to discuss the results of its examinations, its evaluations of the Company's internal control over financial reporting and the overall quality of the Company's financial reporting. The audit committeeAudit Committee held four meetings during the fiscal year ended December 31, 2016.2022.

In reliance on the reviews and discussions referred to above, the audit committeeAudit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 20162022 for filing with the SEC. The audit committeeAudit Committee has also retained EisnerAmperMarcum LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2017.2023.

AUDIT COMMITTEE:

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required during the fiscal year ended December 31, 2016,2022, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were met.

15

Executive Officers

During the year ended December 31, 2022, our named executive officers were:

Robert Moccia, President and Chief Executive Officer

Christopher Lesovitz, Chief Financial Officer

Shmuel Gov, Senior Vice President

The biographical information for our current executive officers (other than Mr. Moccia which is included above) are below:

Christopher Lesovitz (age 41) Since July 11, 2021, Mr. Lesovitz has served as the Company’s Controller. Previously, he led the finance department at Encore Dermatology, Inc., a fully integrated dermatology company. Prior to that, Mr. Lesovitz held various finance roles with Iroko Pharmaceuticals, LLC, a pharmaceutical company specializing in pain management, serving as its Assistant Controller and as its Senior Accounting Manager. Mr. Lesovitz received his Bachelor of Science in accounting from Villanova University in 2004. Additionally, Mr. Lesovitz is a Certified Public Accountant (CPA) in the Commonwealth of Pennsylvania.

Shmuel Gov (age 63) Mr. Gov is the Company’s Senior Vice President and General Manager in charge of operations at the Company’s manufacturing and R&D facility in Carlsbad, CA. He joined the Company in 2015 as Vice President and General Manager. He has over 25 years of experience in medical device manufacturing, logistics, and R&D. He holds degrees in electronics engineering and international business management.

Components of Executive Compensation during 2022

Mr. Moccia receives a base salary at the rate of Five Hundred Ten Thousand Seven Hundred Thirty-One Dollars ($510,731) per annum, and is entitled to receive other incentives as described in his employment agreement under the heading “Employment Agreement with Robert Moccia” below. He is eligible to participate in the Company’s management incentive plan (“MIP”) and is scheduled to receive a bonus payment for fiscal 2022 performance of Two Hundred Ninety-Nine Thousand Six Hundred Seventy-Seven Dollars ($299,677).

Mr. Lesovitz receives a base salary at the rate of Two Hundred Fifty Thousand Dollars ($250,000) per annum, and is entitled to receive a bonus based upon the performance of the Company’s business during the relevant quarters of each fiscal year (“FY”) and other goals to be proposed by the CEO and approved by the Compensation/Nominating and Governance Committee of the Board. He is eligible to participate in the MIP and is scheduled to receive a bonus payment for fiscal 2022 performance of One Hundred and Six Thousand Two Hundred Fifty Dollars ($106,250).

Mr. Gov’s salary in 2022 was Two Hundred Ninety-Four Thousand dollars ($294,000) which will increase by 4.7% in May 2023 to Three Hundred and Seven Thousand Eight Hundred dollars ($307,800). He is eligible to participate in the MIP and is scheduled to receive a bonus payment for fiscal 2022 performance of One Hundred Thirty-Five Thousand Two Hundred Forty Dollars ($135,240).

On March 30, 2022, the Compensation/Nominating and Governance Committee granted the following options to each of Messrs. Moccia and Lesovitz:

VWAP Vesting Options. Mr. Moccia received options to purchase 60,000 shares of common stock under the Company’s 2016 Amended and Restated Omnibus Incentive Plan (the “Plan”), with an exercise price of $1.45 per share, which would vest upon the Company achieving a five trading day volume weighted average per share price ending on December 31, 2022 of $2.00. As this target was not achieved, these options were forfeited for no consideration.

Performance Options. Mr. Moccia received options to purchase shares of common stock under the Plan, with an exercise price of $1.45 per share, which would vest upon the Company achieving a specified net revenue target in relation to the Company’s budget over a 12-month period from January 1, 2022 through December 31, 2022, with a “target” of 100,000 shares. Possible payout ranges from 0% of the Target, to 105% of the Target if the goal were exceeded. The Target was met and the 100,000 shares vested.

16

Time Vesting Options. Mr. Lesovitz received options to purchase 100,000 shares of common stock under the Plan, with an exercise price of $1.45 per share, which would vest in one quarter increments over a four year period ending on March 30, 2026.

Under the MIP, our executives and key management personnel, including the named executive officers, may receive an annual cash bonus upon satisfaction of annual financial and strategic goals, which the Compensation/Nominating and Governance Committee establishes at the beginning of each year. Consistent with our compensation policy, individuals with greater job responsibilities have a greater portion of their total cash compensation tied to our corporate performance through the MIP.

Under the MIP, each participant has threshold, target, and maximum potential cash bonus payouts, which the Compensation/Nominating and Governance Committee establishes at the beginning of each fiscal year. The Compensation/Nominating and Governance Committee bases the potential payments on each participant’s job responsibilities and position within our organization. The potential payouts are stated as a percentage of base salary. In establishing the goals, the Compensation/Nominating and Governance Committee gives significant consideration to our prior year’s performance. Satisfactory individual performance is a condition to payment, and, at the end of each fiscal year, the Compensation/Nominating and Governance Committee can, at its discretion, adjust an individual’s payout under the MIP based on such individual’s performance.

Each year, the Compensation/Nominating and Governance Committee also reviews overall financial performance and adjusts for items that are not reflective of normal operating performance for that year. These adjustments are items that the Compensation/Nominating and Governance Committee believes are fair to both participants and stockholders, encourage appropriate actions that foster the long-term health of the business, and are consistent with the objectives underlying our predetermined performance goals. The adjustments identified by the Compensation/Nominating and Governance Committee at the beginning of fiscal year 2022 included expenses related to merger and acquisition activity, unbudgeted pandemic-related supply chain impacts, the impact of restructuring programs, goodwill and intangible asset charges, the impact of tax or accounting changes, and the effects of foreign currency fluctuations. Regarding the supply chain adjustment, the Compensation/Nominating and Governance Committee included the COVID-19 related impact of global shortages and component supply disruptions of electronic chips, other electronic components, and other materials on these goals. The Compensation/Nominating and Governance Committee also reserves the right to make adjustments with respect to other extraordinary, non-recurring items if there is valid business rationale, however, no such discretionary adjustments were made for the fiscal year 2022 MIP.

For fiscal year 2022, the Compensation/Nominating and Governance Committee selected meeting the Company’s budget revenue plan of both recurring and equipment sales revenue as the criteria for determining potential payments under the MIP. Overall, the Compensation/Nominating and Governance Committee believes that the mix of performance metrics supported the objectives of the business established for fiscal year 2022.

For fiscal year 2022, the total payout as a percentage of target was 87%, as shown in the chart and discussed below.

Executive | | | Bonus as a percentage of base salary | | | Target | | | Approved Bonus |

Robert Moccia | | | 85% | | | $334,750 | | | $284,537 |

Christopher Lesovitz | | | 85% | | | $125,000 | | | $106,250 |

Shmuel Gov | | | 92% | | | $147,000 | | | $135,240 |

The 2022 MIP payouts will be made in May 2023, with the Compensation/Nominating and Governance Committee taking into account the impact of adjustments that they identified at the beginning of fiscal year 2022 and as discussed above. We set forth the amounts due to each named executive officer for fiscal year 2022 performance under “Non-Equity Incentive Plan Compensation” in the Summary Compensation TableTable.

17

SUMMARY COMPENSATION TABLE

The following table sets forthincludes information for the years ended December 31, 2022, and 2021 concerning compensation earned byfor our principalnamed executive officers and other executive officers during our last two completed fiscal years; such officers are referred to herein as the "named executive officers":officers.

Name and Principal Position | Year | Salary ($) | Bonus ($) (4) | Stock Awards ($) (5) | Option Awards ($) (5)) | All Other Compensation ($) (6) | Total ($) |

| Francis J. McCaney (1), Director, President and Chief Executive Officer | 2016 | 56,700 | - | - | 150,273 | 1,000 | 207,973 |

| 2015 | - | - | - | - | - | - | |

| Christina L. Allgeier (2), Chief Financial Officer and Treasurer | 2016 | 200,000 | 30,000 | - | 37,600 | 13,500 | 281,100 |

| 2015 | 90,679 | 30,000 | - | - | 7,076 | 127,755 | |

| Michael R. Stewart (3), Former Director, President and Chief Executive Officer | 2016 | 344,240 | - | - | - | 388,661 | 732,901 |

| 2015 | 313,570 | 255,000 | 109,000 | - | 37,436 | 715,006 |

Name and Principal Position | | | Year | | | Salary | | | Non-Equity Incentive Plan Compensation ($)(1) | | | Options(2) | | | All Other Compensation(3) | | | Total |

Robert Moccia, Director, President and Chief Executive Officer | | | 2022 | | | 510,731 | | | 299,677 | | | 144,920 | | | 27,200 | | | 982,528 |

| | 2021 | | | 403,846 | | | — | | | 1,784,421 | | | 18,804 | | | 2,207,071 | ||

| | | | | | | | | | | | | |||||||

Chris Lesovitz, Chief Financial Officer | | | 2022 | | | 250,000 | | | 42,462 | | | 94,000 | | | 21,292 | | | 407,754 |

| | 2021 | | | 97,346 | | | — | | | 296,500 | | | 3,000 | | | 396,846 | ||

| | | | | | | | | | | | | |||||||

Shmuel Gov, Senior Vice President and General Manager | | | 2022 | | | 290,016 | | | 154,910 | | | 65,800 | | | 25,594 | | | 536,320 |

| | 2021 | | | 264,465 | | | 55,363 | | | — | | | 18,600 | | | 338,428 |

| (1) | |

Overview of Executive Employment Agreements and Payments upon Termination or Change of Control

Employment Agreement with Francis J. McCaney.Robert Moccia

On October 31, 2016, weMarch 1, 2021, the Company entered into an employment agreement with Robert Moccia to become the Company’s Chief Executive Officer, (the “Employment Agreement”), which provides for, among other things, (i) a three-year term commencing on March 1, 2021, which renews for successive one year additional terms unless a party gives the other party a notice of non-renewal at least 90 days prior to the end of the then applicable employment term, (ii) an annual base salary of $500,000, (iii) an incentive bonus opportunity equal to at least 65% of his base salary for such year, (iii) an initial option (the “Option”) to purchase 1,632,590 shares of common stock, with a strike price as of the close of trading on March 1, 2021 which was $1.73, vesting over a three year period, with 544,198 options vesting on the first anniversary of the date of grant and 136,049 options vesting every three months thereafter and subject to acceleration under certain conditions, (iv) participation in long-term incentive plans and employee benefit plans, including health and 401(k) plans, (v) 20 days of annual vacation, plus 10 established holiday days, per full calendar year of employment, (vi) an automobile allowance of $1,250 per month, and (vi) his appointment to the Company’s board of directors as of March 1, 2021, and nomination and recommendation for election as a director thereafter at annual meetings of stockholders during his employment term when his election is to be considered. The Option is intended to constitute an employment inducement grant under Nasdaq Listing Rule 5635(c)(5). The Company will also pay Mr. Moccia a bonus equal to two times his then base salary if, during the term of his employment, (a) a “Change in Control” (as defined in the Company’s 2016 Omnibus Incentive Plan, as amended from time to time) occurs and (b) as of such Change in Control, the price per share of the Company’s common stock is two times or more than the price of the Company’s common stock as of March 1, 2021.

The Employment Agreement provides Mr. Moccia with severance benefits in the event that his employment is terminated under certain circumstances, including by Mr. Moccia for “Good Reason” and by the Company without “Cause” (each as defined in the Employment Agreement). Upon the termination of Mr. Moccia’s employment, he will automatically resign as a member of the Company’s board of directors. Pursuant to the Employment Agreement, Mr. Moccia is subject to confidentiality, assignment of intellectual property, and restricted activities covenants, the latter of which continues for 12 months after his separation from employment.

18

Employment Agreement with Francis J. McCaney, our President andChristopher Lesovitz

On October 4, 2021, the Company entered into an employment agreement with Christopher Lesovitz to become the Company’s Chief Executive Officer. Under the terms of the agreement, Mr. McCaney will receive aFinancial Officer, (the “Employment Agreement”), which provides for, among other things, (i) an annual base salary of $375,000 and will be eligible$250,000, (ii) an incentive bonus opportunity equal to receive a bonus of up toat least 50% of his base salary per annum, starting for fiscal year 2017, based on achievement of specified milestones, as determined by our Board based upon annual budgets approved by our Board from time to time, provided that the cash bonus for 2016 shall be prorated based upon the portion of such fiscal year during which Mr. McCaney was employed pursuant to the agreement.

The Employment Agreement provides Mr. Lesovitz with severance benefits in the event that yearhis employment is terminated. In the event of, and will no longer become exercisable. Ifonly upon, the termination of the employment of Mr. Lesovitz under the Employment Agreement (i) we undergo(A) upon a change“Change of control beforeControl” (as defined in the stock option vests in fullEmployment Agreement) unless the new controlling person or entity of the Company’s business and/or assets determines otherwise and (ii) Mr. McCaney is(B)(1) if Employee has not been offered post-changepost-Change of controlControl employment by usthe Company or any successor entity, or (2) if Employee is offered such post-changepost-Change of control employment and Mr. McCaney terminates his employment for good reason (as those terms are defined in the employment agreement) within a period of 30 days after the date of the change of control, conditioned upon his execution of a release satisfactory to us, all such stock options that have not previously terminated shall accelerate and shall vest in full upon the effective date of the termination of Mr. McCaney's employment.

Severance Agreement with Shmuel Gov

As of August 2, 2021 the Company entered into a severance agreement with Mr. Gov, providing for certain benefits and payments in the event of a release satisfactory to us, severanceChange in Control, as defined in the amount of his then current base salary for 12 months.

Outstanding Equity Awards Value at Fiscal Year-End Table

The following table includes certain information with respect to the value of all unexercised options and unvested shares of restricted stock previously awarded to the executive officers named above at the fiscal year end, December 31, 2022.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END TABLE

| | | Option Awards | |||||||||||||

Name | | | Grant Date | | | Number of Securities Underlying Unexercised Options (#) Exercisable(1) | | | Equity Incentive Plan Awards Number of Securities Underlying Unexercised Unvested Options (#) | | | Option Exercise Price | | | Option Expiration Date |

Robert Moccia | | | 3/1/2021 | | | 57,803 | | | 115,606 | | | $1.73 | | | 3/1/2031 |

| | 3/1/2021 | | | 894,542 | | | 564,639 | | | $1.73 | | | 3/1/2031 | ||

| | 3/30/2022 | | | 0 | | | 100,000 | | | $1.45 | | | 3/30/2032 | ||

Christopher Lesovitz | | | 10/18/2021 | | | 62,500 | | | 187,500 | | | $1.88 | | | 10/18/2031 |

| | 3/30/2022 | | | 0 | | | 100,000 | | | $1.45 | | | 3/30/2032 | ||

Shmuel Gov | | | 6/7/2016 | | | 15,000 | | | 0 | | | $3.75 | | | 6/7/2026 |

| | 6/4/2028 | | | 200,000 | | | 0 | | | $1.93 | | | 6/4/2028 | ||

| | 11/22/2019 | | | 100,000 | | | 0 | | | $2.46 | | | 11/22/2029 | ||

| | 11/13/2020 | | | 66,666 | | | 33,334 | | | $1.46 | | | 11/13/2030 | ||

| | 3/30/2022 | | | 0 | | | 70,000 | | | $1.45 | | | 3/30/2032 | ||

| Francis J. McCaney | - | 108,500 | 201,500 | 2.75 | 10/31/2026 | 0 | 0 | N/A | N/A |

| Christina L. Allgeier | 2,500 | 17,500 | 0 | 3.75 | 6/7/2026 | 0 | 0 | N/A | N/A |

| Options granted |

20

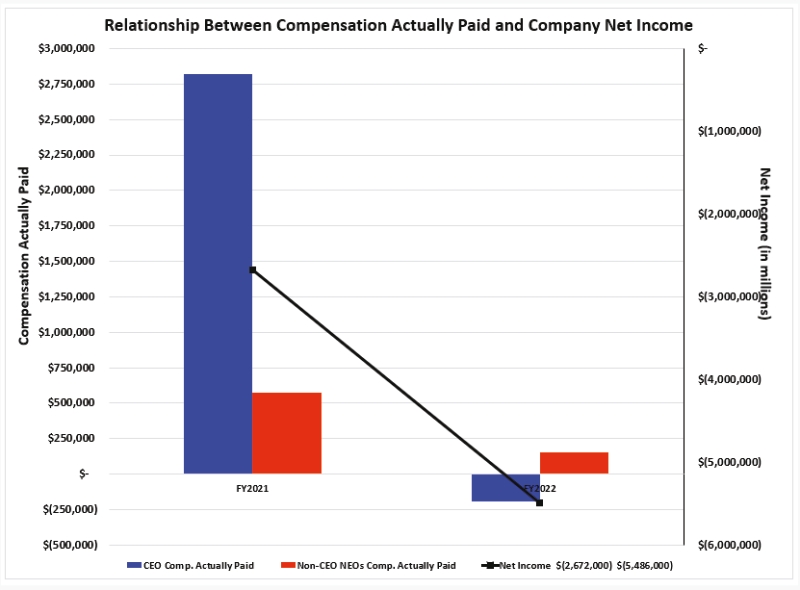

PAY VERSUS PERFORMANCE INFORMATION

In August 2022, the SEC adopted final rules to implement Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The following information about the relationship between executive compensation actually paid and certain financial performance of the Corporation is provided pursuant to Item 402(v) of SEC Regulation S-K.

Year | | | Summary Compensation Table Total for Principal Executive Officer (“PEO”)(1) | | | Compensation Actually Paid to PEO(2) | | | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”)(3) | | | Average Compensation Actually Paid to Non-PEO NEOs(4) | | | Value of Initial Fixed $100 Investment Based On Total Shareholder Return (“TSR”)(5) | | | Net Income (Loss) (millions)(6) |

(a) | | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) |

2022 | | | $982,528 | | | ($193,553) | | | $642,201 | | | $155,577 | | | $53.00 | | | ($5,486) |

2021 | | | $2,207,071 | | | $2,822,557 | | | $367,637 | | | $574,437 | | | $98.00 | | | ($2,672) |

| (1) | The dollar amounts reported in column (b) are the amounts of total compensation reported for Mr. Robert Moccia (President and Chief Executive Officer) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation—Summary Compensation Table.” |

| (2) | The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Moccia, as computed in accordance with Item 402(v) of SEC Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Moccia during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Moccia total compensation for each year to determine the compensation actually paid: |

Year | | | Reported Summary Compensation Table Total for PEO ($) | | | Reported Value of Equity Awards(a) ($) | | | Equity Award Adjustments(b) ($) | | | Compensation Actually Paid to PEO ($) |

2022 | | | $982,528 | | | $144,920 | | | ($1,031,161) | | | ($193,553) |

2021 | | | $2,207,071 | | | $1,784,421 | | | $2,399,907 | | | $2,822,557 |

| (a) | The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” columns in the Summary Compensation Table for the applicable year. |

| (b) | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) an amount equal to the change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same applicable year, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in the applicable year, an amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. The amounts deducted or added in calculating the equity award adjustments are as follows: |

Year | | | Year End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year ($) | | | Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years ($) | | | Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year ($) | | | Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year ($) | | | Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation ($) | | | Total Equity Award Adjustments ($) |

2022 | | | $79,000 | | | ($462,567) | | | n/a | | | ($647,595) | | | n/a | | | n/a | | | ($1,031,161) |

2021 | | | $2,399,907 | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | $2,399,907 |

21

| (3) | The dollar amounts reported in column (d) represent the average of the amounts reported for our company’s named executive officers as a group (excluding Mr. Moccia) in the “Total” column of the Summary Compensation Table in each applicable year. The names of each of the named executive officers (excluding Mr. Moccia) included for purposes of calculating the average amounts in each applicable year are as follows: for 2022 and 2021, Mr. Chris Lesovitz and Mr. Shmuel Gov. |